case report

Trends and Challenges of Health Care Financing in Nigeria

Department of Community Medicine, College of Medicine, Enugu State University of Science and Technology, Nigeria.

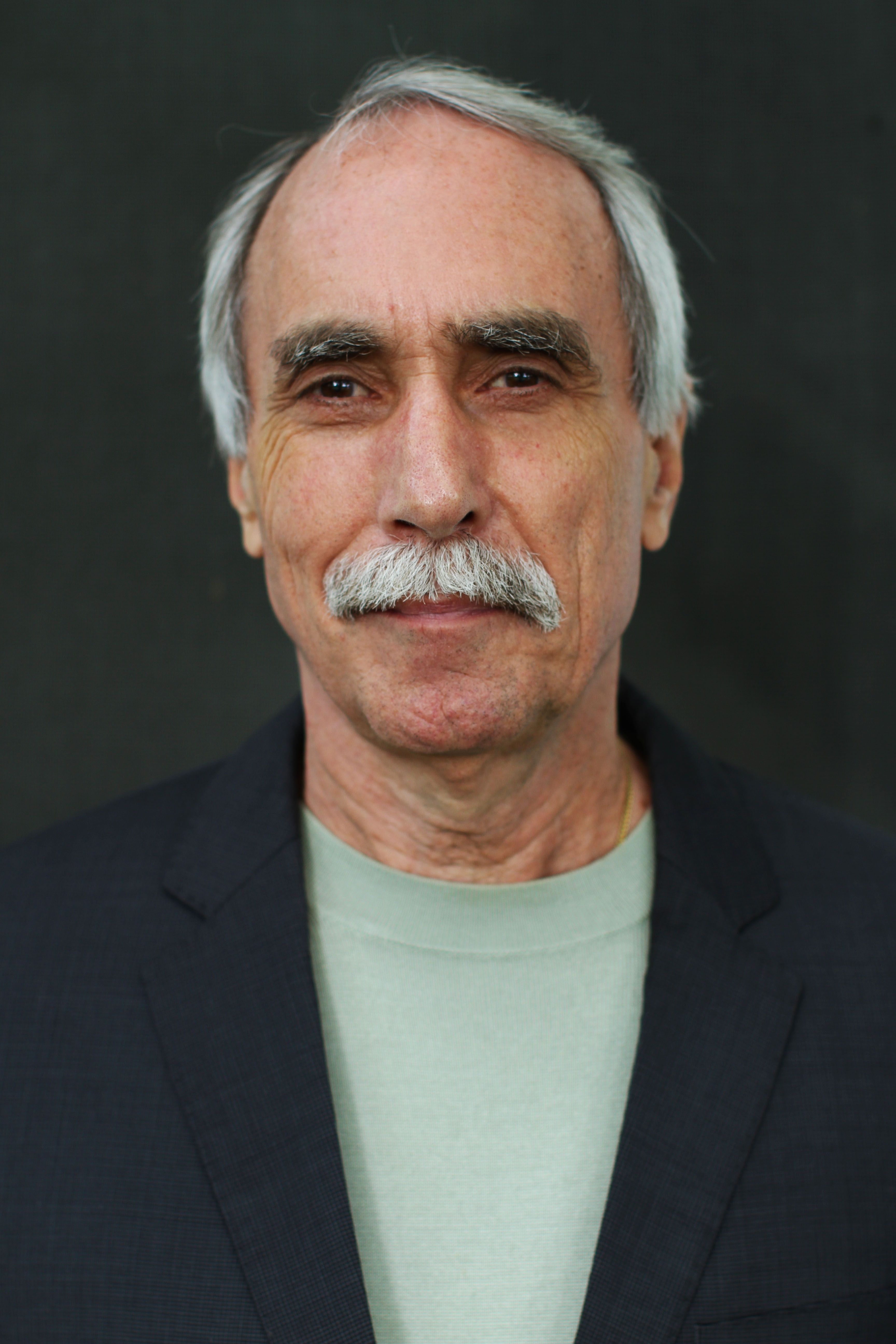

*Corresponding Author: Okechukwu Chime Ogbodo,Department of Community Medicine, College of Medicine, Enugu State University of Science and Technology, Nigeria.

Citation: Okechukwu C. Ogbodo. (2023). Trends and Challenges of Health Care Financing in Nigeria, International Journal of Medical Case Reports and Reviews, BioRes Scientia Publishers. 2(5):1-12. DOI: 10.59657/2837-8172.brs.23.030

Copyright: © 2023 Okechukwu Chime Ogbodo, this is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Received: August 22, 2023 | Accepted: September 09, 2023 | Published: September 12, 2023

Abstract

Introduction: Health care financing is concerned with how financial resources are generated, allocated and used in health care system. Worldwide, every year 100 million people are pushed into poverty because they have had to pay directly for their health care.

Objective: To assess the trends and challenges of health care financing in Nigeria.

Methodology: A literature review was conducted.

Results: In Nigeria, health care is financed through Tax revenues, out of pocket payments (user payment), health insurance (social, community-based insurance, private health care financing), donor funding, exemptions/deferrals/subsidies. Majority (69%) of the health care financing in Nigeria is from out-of-pocket payments made by the patient to the health care provider. The federal government provides 12% of health care finances. The rest of financing of health care in Nigeria come from the state governments (8%), Local Government areas (4%), and development/donor partners (3%). Nigeria allocates between 3.5% and 6.24% of her total budget to health care financing. The challenges of health care financing in Nigeria include: inefficiency of the health system across the country, limited institutional capacity, corruption, unstable and dwindling economic, and lack of political will.

Conclusion: Nigeria’s expenditure on health is very low, and domestic resource mobilization for health care is weak. Nigeria’s health system has to be strengthened. Nigeria also has to inject more fund into health care for its citizens. She should embrace equitable modes of health care financing such as compulsory social insurance system for all citizens of Nigeria. The role of different levels of government in financing health care should be clearly defined. Also, prudent management of available scarce funds will go a long way in changing the Nigerian health care financing situation. The private sector (telecommunications and banks) and local philanthropists has to be involved in financing health care. There should be effective monitoring and evaluation (M&E) of performances and tracking of the use of resources, health policies and reforms.

Keywords: health; financing situation; patients

Introduction

World Health Organisation (WHO) defined health as health as a state of complete physical, mental, and social well-being and not merely the absence of disease or infirmity.1 The health of a nation significantly enhances its economic development by increasing productivity2 Therefore, provision of better health should not await an improved economy, rather increase in health care financing and subsequent improvement in health will themselves contribute to economic growth.3 A country can achieve universal health for all if it has adequate health care financing mechanisms and a strong health system, because these are the key determinant of the health of its citizenry and the country’s economic development [4].

Health care system consists of all the activities whose main aim is to promote, restore or maintain health, while Health care financing is concerned with how financial resources are generated, allocated and used in health care system [5]. The objectives of health financing are to make funding available, ensure appropriate choice and purchase of cost-effective interventions, give appropriate financial incentives to providers and ensure that all individuals have access to effective health services [6]. Globally, the common mechanisms employed for health care financing are: tax-based financing, out-of- pocket payments, donor funding, and health insurance (social, community and private) [7]. These sources can also be classified as public, quasi- public and private sources [8,9]. Worldwide, every year 100 million people are pushed into poverty because they have had to pay directly for their health care [5]. Therefore, adequate financing of public health care system is needed to achieve universal health care for all populations, particularly people with greatest health care needs [10]. This research will make an overview of Nigeria’s health care financing and make recommendations for effective health care financing in Nigeria. This will ensure the best health care financing mechanisms for Nigeria that will provide sufficient financial protection so that no household is impoverished because of a need to use health services [11].

Method

A literature review was conducted and requires no ethical approval. Searches of Pubmed, Embase, HINARI, AJOL, and EconLit were under-taken and based on the Boolean expression: [social OR national OR health] AND [insurance OR health care financing] AND [Nigeria OR Africa OR Sub-Saharan Africa OR Europe OR Asia OR World]. I also searched PubMed, Medline, The Cochrane Library, Popline, Science Direct, Google scholar and WHO Library Database with search terms/phrases that included, but were not restricted to health care financing Nigeria, public health financing, financing health, financing health systems and financing policies. Further publications were identified from references cited in relevant articles and reports. I reviewed only papers published in English. No date restrictions were placed on searches.

Results

Public Health Care System in Nigeria

There are three levels of care providing public health services in Nigeria. The levels are: primary, secondary and tertiary which are managed by the local, state and federal governments respectively [12]. The Nigeria National Health Policy is also meant to strengthen the national health system such that it would be able to provide effective, efficient, quality, accessible and affordable health services that will improve the health status of Nigerians. The Nigeria National health act signed into law in December 2015 is also another instrument meant to effectively finance health care in Nigeria. Sources of Public Health Care Financing System in Nigeria

Health care financing involves the collection of funds from various sources (government, households, businesses, and donors), pooling them to share financial risk across larger population groups and using them to pay for services from public and private health care providers [13,14]. In Nigeria, health care is financed through Out-of-pocket payments (user payment), Health insurance (social, community-based insurance, private health care financing), donor funding, exemptions/deferrals/subsidies [15]. Out-of-pocket payments (OOPPs) are payments made directly by a patient to a health service provider. OOPPs are also called user fees, and are paid at the point of service. The scope of user fees is variable and can include any combination of drug costs, medical material costs, entrance fees, and consultation fees [16]. In 2018 OOPS accounts for 76.6 percent of total health expenditure in Nigeria [17]. But on patients account it is on the average 69% of the total health expenditure in five years preceding 2016 [18]. It places a significant burden on households, and affects the ability of households and individuals to meet basic needs, pushing most below the poverty line. In Nigeria, about 4% of households are estimated to spend more than half of their total household expenditures on health care and 12% of them are estimated to spend more than a quarter [11]. Therefore, there is an over-reliance on out-of-pocket payments in Nigeria. This is a serious burden to Nigeria as about 70% of Nigerians are living in poverty [19]. High OOPS as a source of health-care financing negatively affects people’s living standards and welfare [19]. Out-of-pocket payments can make households and individuals incur catastrophic health expenditure ( household expenditure on health care is greater than 40% of non-food expenditure) and this can exacerbate the level of poverty [20].Studies in Enugu and Anambra States in Nigeria showed that the incidence of catastrophic health expenditure among households were 14·8% and 27%, respectively.21,22 However, Studies from Southeast and Southwest [23,28].Nigeria show that 23% and 11% respectively of all households sampled experienced catastrophic payments for health care. These estimates were higher among those enrolled in health insurance in the poorest households and in rural dwellings and highest among those not enrolled [23,24]. However, among those in the richest quintile in Southeast Nigeria, only 8% of households experienced catastrophic costs [23].

This shows the inequality in ability to finance health care among the rich and the poor

Tax revenue health financing system or Beveridge system is a health financing system whereby the main source of health care expenditure is government revenues [25]. Public health facilities in Nigeria are financed primarily by Tax revenue health financing system. The health system is generally funded from federation account to the federal, states and Local Governments. The states and Local Government areas (LGAs) also generate about 20% internal revenue from taxes, rates and levies. The allocation of federal revenues is fixed by the Revenue Mobilization, Allocation and Fiscal Commission and the allocation formula assigns 48.5% to the federal government, 24% to the states and 20% to local government, with 7.5% retained for “special” federally determined projects with limited room for manoeuvres on fiscal policy [26]. The federally collected revenue consist of crude oil and gas export proceeds, petroleum profit tax, royalties and the related proceeds of domestic crude oil sales/other oil revenues, companies’ income tax, customs and exercise duties, value-added tax (VAT), tax on petroleum products, education tax, and other items of independent revenues to the federal government [6].

Gross Domestic Product GDP is the most important determinant of health allocation in Nigeria [27]. yet Nigeria spends less than 5% of their gross domestic product (GDP) on health, and annual per capita health spending is far less than US$ 35 proposed by Commission on Macroeconomics and Health [11]. In the Abuja Declaration which Nigeria and 43 other African countries signed in 2001 [28]. They committed themselves to spending 15% of their annual budgets on public health. [6]. Pooling arrangements is essentially the collection and management of prepaid health care resources on rust for the population, ensuring that the cost of health care is distributed among all the members of the pool. In Nigeria pooling arrangement is usually in form of different forms of health insurance such as public/social health insurance, community-based health insurance, and private health insurance. The Nigeria National Health Insurance Scheme (NHIS) came into effect in (2005). Less than 5% of Nigerians have health insurance coverage; most enrolees are in the formal sector with very poor coverage in the informal sector [29,30,31]. Specifically the 2018 Nigeria Demographic and Health Survey, only 3% of people aged 15–49 years have a form of health insurance coverage [32].Two states (Bauchi and Cross River) have attempted enrolling their employees, and nine states (Abia, Enugu, Gombe, Imo, Jigawa, Kaduna, Lagos, Ondo, and Oyo) have indicated interest in NHIS [19].NHIS is also offering limited community based health insurance for the informal sector run on a non-profit basis and they apply the basic principle of social health insurance [6].

Some states in Nigeria such as Lagos, Kwara, Ogun, and Akwa Ibom are implementing state-led community-based health insurance programmes to reach the informal sector with varying levels of coverage and inherent sustainability challenges [33]. Private health insurance (PHI) also exists in Nigeria and is funded through direct and voluntary pre-payments by insured members [29]. This is an arrangement under which workers and specified dependants obtain medical treatment in designated hospitals at the expense of their employers [6].

Donors such as the World Health Organization, World Bank and United Nations Children Fund are expected to donate 0.7% of their gross national product as Official Development Assistance (ODA) to developing countries.34 The annual average ODA inflow to Nigeria in 1999 and 2007 was estimated at US$2.335 and US$4.674 per capita respectively [35]. These figures are way below the Sub- Saharan African average of US$28 per capita [35]. Debt relief funds accruing to Nigeria over the past years were used to finance Primary Health care (PHC) and to sponsor free distribution of insecticide-treated bed nets and anti-malarial drugs to pregnant women and children under five [36]. The user fees have been removed or subsidised by the Nigeria government and some states for the treatment of malaria in the under-5 children and pregnant women [37]. Majority of states in the country have policies and programmes aimed at providing free Maternal and Child Health MCH Services. But funding level, benefit package and coverage show wide variation across states [6]. This kind of health care financing strategy is associated with fraud and corruption.

Trends of Health Care Financing in Nigeria

According to WHO, Nigeria government expenditure on health as a percentage of total government expenditure was very low at 3.3% in 2002, increasing consistently per year to 9.4% in 2007, and dropped to 6.7% in 2012 [16]. The total government health expenditure as a proportion of Total Health Expenditure (THE) was estimated as 18.69% in 2003, 26.40% in 2004, and 26.02% in 2005 [15]. In monetary terms, the annual government expenditures on health were $533.6 million in 1980 after which it nose-dived, reaching a trough of $58.8 million in 1987. By 1999, significant increases in health expenditure were noticed, reaching a peak in 2002 at $524.4 million [11]. However, Nigeria annual expenditure on health dropped significantly in subsequent years, and was N33.3 billion (3.4%) in 2003, N34.2 billion (3.0%) in 2004, N55.7 billion (4.2%) in 2005, N62.3 billion (4.5%) in 2006 and N89.6 billion (5.6%) in 2007, a clear downward trend [6]. Thus, average health sector total capital expenditure in the period 2003 to 2007 was 5.0% compared with allocation to agriculture, (13.7%), education (6.5%), administration, (33.1%), economic services, (47.9%) [6]. In recent years, Nigeria allocated 5.6%, 3.7%, 6.24%, 4.64%, and 4.17% of her total budget to health care financing in 2013, 2014, 2015, 2016, and 2017 respectively [18]. and N71.11 billion for 2018. However, Nigeria budgetary allocation for health in 2023 is 8 percent of Nigeria's total budget, compared to 5.35 percent for 2022 [38]. Nigeria’s budgetary allocation for health is still below 15% of her annual budget. Evidence from a Public Expenditure Review of the health sector and National Health Accounts (NHA) suggests that on average, most states spend less than 5% of their total expenditure on health care [11]. In Northern Nigeria, the public sector provides over 90% of all health services, in contrast to states in Southern Nigeria where the private sector provides over 70% of health services, mostly on a fee-for-service basis [39].

The total health expenditure (THE) as percentage of the gross domestic product (GDP) from 1998 to 2000 was less than 5%, falling behind THE/GDP ratio in other developing countries such as Kenya (5.3%), Zambia (6.2%), Tanzania (6.8%), Malawi (7.2%), and South Africa (7.5%) [14]. The following ECOWAS states also spent more proportion of their Gross Domestic Product on health care financing than Nigeria in 2011: Sierra Leone, Mali, Niger, Burkina Faso, Senegal, Benin, Togo, Liberia, Ghana, Cape Verde, and Gambia [18].

Out-of-pocket payments (OOPPs) account for the highest proportion of health expenditure in Nigeria. OOPPs expenditure as a proportion of THE averaged 64.59% from 1998 to 2002 [14]. In 2003, OOPPs accounted for 74% of the Total Health Expenditure (THE); it decreased to 66% in 2004 and later increased to 68% in 2005 [15].and in recent years, it is hovering at 69% [18]. Private expenditure on health as a percentage of total health expenditure remains high, overall dropping slightly from 74·4% in 2002, to 68.9% in 2012 [18]. Out-of-pocket expenditure as a percentage of private expenditure on health has also consistently remained higher than 90% since 2002, and was 95.7% in 2012 [18]. This implies that households bear the highest burden of health expenditure in Nigeria.

Challenges of Health Care Finance Systems in Nigeria

Achieving a successful health care financing system continues to be a challenge in Nigeria. Health indicators in Nigeria have not changed substantially due to the non-responsiveness of the health system to the needs and expectations of the population. Unfortunately, for many years, there has been no action taken by political actors and policy makers. Most people seem to have accepted life with this terrible situation since there is not much they can do to reverse it. Too many patients have died due to inefficiency of the health system across the country. Limited institutional capacity, corruption, unstable economic, and political context have been identified as factors why some mechanisms of financing health care in Nigeria have not worked effectively [40].

Inadequate political commitment to health has led to poor funding of health in general, and funding of PHC in particular. Nigeria health policy did not clearly spell out how funds are to be allocated and spent in the health sector. This has led to ineffective use of the meagre financial resources available to the health sector in Nigeria [39]. Also, several stakeholders, including development partners finance health independently in a way that is not in accordance with government policy thrust leading to inefficient use of scarce resources and duplication of efforts [41]. Nigeria is also not exploiting other sources of health financing. There are also gaps in the area of stewardship and governance as evidenced by lack of clarity of the role of government at all levels in financing health care.

Very high Out-of-pocket payment for health-care services is a very big challenge in Nigeria. Therefore, accessing health care depends on financial abilities of individuals, families, communities, and the entire population. NHIS has lost focus recently. Governance issues with the NHIS are a big challenge. Another major setback of NHIS is that the unemployed citizens which constitute a larger percentage of the population will not have access to health care service delivery which further widens the gap of health inequalities in the society. More so, the principal funding is from the government which is already associated with corruption, poor political drive and commitment. NHIS is limited to only 5% of Nigerians. This is a huge challenge when we consider that Nigeria has an estimated population of 180 million. Community-based health insurance scheme is non-existence in most states across the country. There is also poor buy-in into NHIS by Nigerian states, thereby limiting coverage. Private health insurance in Nigeria is still at its infantile stage and is expensive and unreliable. There are also no effective risk protection mechanisms such as fee exemptions, making the cost of seeking care very prohibitive for the many poor people in Nigeria. It therefore implies that the quality of health care services in the country may continue to dwindle and remain unsatisfactory unless the government embarks on a drastic health reformation exercise [40].

Discussion

The way health care is financed varies across different countries [7]. The Nigerian health care funding system is still evolving and is still unable to tackle the numerous challenges facing health care financing in Nigeria. Nigeria finances its public health care through tax revenue (by the federal, state and local government), out of pocket payments (also refers to as user fees), pooling arrangements, donor funding and free medical services to the vulnerable groups [42]. OOP payments at 69% of total health expenditure is by far the dominate health care financing option in Nigeria [36,34]. and in most developing countries [45]. OOP payment is a major limitation if an expensive healthcare service is to be accessed [34] and leads to poor health seeking behaviours [46], and inequity in health care provision [47]. The Nigerian NHIS despite its intended purposes48,49 has been able to enrol about 5% of Nigeria population. France has a well-established social health insurance system because it is compulsory and operates as a form of taxation. Social health insurance system is also the predominant system in several countries such as Switzerland, Belgium, Japan, and countries in Latin America. In these countries, the government is the regulator of the system while the main source of funding is through compulsory social health insurance. The Philippines and Vietnam are expanding their health financial protection by encouraging voluntary enrolment in social health insurance programs [50]. In Africa, Rwanda has achieved remarkably high voluntary insurance coverage [51]. Ghana’s national health insurance program is financed mainly with monies from general taxation through a value- added tax, and is compulsory for the formal sector and voluntary for the informal sector, and free for the poorest members of the population [52]. Ghana’s national health insurance program has successfully enrolled approximately 65% of the population. Nigeria offers a variable benefits package depending on membership category, while Ghana has uniform benefits across all beneficiaries. Both countries exhibit improvements in equity but there is a pro-rich and pro-urban bias in membership [52]. This has also brought about inequalities in specialized care among the beneficiaries of different insurance schemes [41].

Nigeria cannot adopt the private health insurance system obtainable in the USA because widespread poverty and unemployment would not allow private health insurance to thrive well in the country. The gap of health inequities and lack of access to health care services will widen in the Nigerian society if private health insurance is the predominant health financing option in Nigeria [40]. However, Private health insurance, also called the market system, is the significant and predominant source of funding in the Uni ted State of America (USA) [53]. Health care is seen to be like other commodities, the government has a limited role and private provision (often for profit) predominates. Thus, Health care funding in the United States of America is primarily a part of the private sector in which private entrepreneurs is free to sell their services for a profit to those who are willing and able to pay. The cost fall directly on the patient whose bills are usually picked up by insurance companies to which their clients pay regular premiums [54].

The United Kingdom (UK) National Health Service (NHS) is also far ahead of the Nigerian NHIS because it ensured equal access to medical care for all citizens with no cost at the point of delivery [55]. The UK NHS is a good example of a health care financing through general taxation, and is named after William Beveridge, the daring social reformer who designed Britain's National Health Service [25]. UK NHS ensure equal access to medical care for all citizens with no cost at the point of delivery [55]. UK NHS is totally committed to the belief that effective health care should be provided as a public service to all those who need it. However, the association of the NHS funding system with the government is a draw back because it may lead to excessive rationing, poor quality of service and to some extent closely tied to the economy and government taxation policies. Other countries effectively practicing taxation system of health care financing include Spain, Scandinavia, Cuba, New Zealand, and Hong Kong, and most of the health services provided are free. Thailand has also used funds from general taxation that are channelled to ministries of health or local health authorities to provide free and quality health care to the people [50]. In South African, health care system is funded through general taxation. Direct payments and out- of- pocket expenses prevail like in the Nigerian system. However, the South African system differs in terms of having a better private health sector involvement and enhanced government funding.

Conclusion

Worldwide, there is no perfect health care funding system; all have their own merits and demerits. Nigeria needs a health care financing system that can sustain and improve health care service delivery to the whole population irrespective of patients’ financial status. Good health policy and strong health system transfer adapted to local condition will help governments make better policy decisions, and proceed sensibly in the face of health care financing challenges [56]. The health of any nation is very vital to the development of that country. Therefore, for Nigeria to develop, the health care sector must be adequately funded. This will make the population healthy. Healthy Nigerian can then work, earn, and save, and contribute to economic growth. Adequate investment in health care financing will also catalyse a robust health-care market that will create many jobs for the Nigerian people within the public and private sectors. Also, governments that facilitate substantial progress towards providing accessible, quality, and cost-effective health care, as in Thailand and Rwanda, are perceived favourably by their citizens and are more likely to be re-elected to serve them again.

The Way Forward/Recommendation

Expenditure on health has been very low in Nigeria and domestic resource mobilisation is weak.Therefore, Nigeria needs to implement health policies and strengthen her health system with sufficient resources. OOP payments should be replaced with equitable modes of health care financing such as compulsory social insurance system for all citizens of Nigeria. The Nigerian government should review the financing and management of Primary Health Care (PHC). There should be clear policies on Primary Health Care (PHC). The role of different levels of government in financing and managing PHC should be clearly defined. The implementation of the National Health Act should start immediately. This act sets the background to earmark adequate public resources to health towards strengthening primary health care through the Basic Healthcare Provision Fund. 50% of the fund will be managed by the National Health Insurance Scheme to ensure access to a minimum package of health services for all Nigerians and 45% by the National Primary Healthcare Development Agency for primary health- care facility upgrade and maintenance, provision of essential drugs, and deployment of human resources to primary health-care facilities. The Federal Ministry of Health will manage the remaining 5% for national health emergency and response to epidemics. Counterpart funding from state and local governments is also needed in implementation of the National Health Act implementation. Nigeria should creatively and aggressively explore innovative domestic financing mechanisms that are beneficial to the people. UK health financing model is based on equality and social justice, while US system represents the free enterprise culture of the country. In Nigeria, there is social solidarity and brotherliness in all activities involving her different and diverse people. Therefore, Nigeria NHIS should be extended to the informal sector through the Community-Based Health Insurance (CBHI). Individuals, families and communities can make voluntary contributions to support the cost of health care services. The private sector (telecommunications and banks) and local philanthropists has to be involved in financing health care. Concerning telecommunication industry, an arrangement can be made whereby a certain percentage (to be determined) of each recharge card purchased goes into the revenue pool for financing health. Donors should do more to meet their stated international commitments for Official Development Assistant (ODA) and to provide more predictable and long-term aid flows in Nigeria. Tax avoidance and inefficient tax collection are major roadblocks that the new government should tackle to improve domestic revenue generation. Lagos successfully increased its monthly internally generated revenue from N600 million to N20 billion between 2000 and 2010. Lagos’s example should be adapted at the national and sub-national levels in Nigeria to expand fiscal space and prioritise health investments. Sufficient funds can be obtained through “sin taxes” on products that pose risk to health, such as tobacco and alcohol. There should also be progressive levies on phone calls (over 90 million Nigerians own and use mobile phones) or mobile phone purchases, and taxes on air tickets, foreign exchange transactions, and luxury goods. Other possibilities for innovative fund-raising include, raising diaspora bond (from our large diaspora population), and taxing specific profitable sectors of the economy like banking, oil and gas. Rwanda’s exemplary health-system reforms offer important lessons for Nigeria. This Rwandan success has been attributed to innovative policy making and the alignment of vertical donor funding with horizontal government-driven priorities. With a strong stance against corruption, Nigeria government can mobilise and align resources from domestic and external sources, and ensure efficient use of such resources to increase access to high-quality health care for Nigerians. The government should commit itself to the 2001 Abuja declaration by allocating at least 15% of its budget to health sector. Nigerian President should sign the amended NHIS Act passed by the Seventh National Assembly and ensure full implementation. This will ensure that majority of Nigerians are covered by NHIS, and will provide access and equity to health care as obtained in Colombia, Thailand and India. Each state government should create its health insurance agency with guidance from the NHIS and implement innovative ways to capture the formal and informal sectors. These steps will greatly increase health insurance penetration across the country. The private sector could be a key player in delivering health services and impacting health outcomes, including those related to healthcare financing. Also, government should strive to promote the development of industries and relevant manpower to enhance local capabilities in the production of drugs, including Anti Retro Viral and laboratory reagents, medical equipment and spare parts to improve supplies and maintenance capabilities so as to reduce cost and improve efficiency. Furthermore, there should be a ban on the financing of government officials going overseas for medical treatment. Better mind-sets and behaviour, Pay-for- performance bonuses and other incentive programs would motivate health workers to provide high-quality care efficiently. Prudent management of the scarce funds will go a long way in changing the Nigerian health care financing situation. To achieve this, the Federal Ministry of Health will need to provide strategic and progressive leadership. A leadership that is willing to discard failed and tired structures, systems and indeed individuals. There should be effective monitoring and evaluation (M&E) of performances and tracking of the use of resources, health policies and reforms. Implementation of health financing policies and actions need to be monitored and evaluated at regular intervals. The current WHO agreements on intellectual property rights, which effectively limit the access of the poor countries to essential medicines and cheap drugs, must also be opposed by Nigeria government. More funds should be set aside for recruitment, training and retraining of health workers so that they can be more efficient. The implementation of financing initiatives including conditional cash transfers, free health care for vulnerable groups, health insurance for the formal sector, and community-based health insurance (CBHI) schemes for the informal sector, can help to address the widening geographic and socioeconomic disparities in individual’s ability to finance health care. If these recommendations are adequately implemented, financing health care in Nigeria will have limited burden on those that need health care.

References

- Komrokji, R.S. et al. (2016). Autoimmune diseases and myelodysplastic syndromes. American journal of hematology, 91(5):280-283.

Publisher | Google Scholor - Wolach, O. and R. Stone. (2016). Autoimmunity and inflammation in myelodysplastic syndromes. Acta haematologica, 136(2):108-117.

Publisher | Google Scholor - Seguier, J., et al. (2019). Autoimmune diseases in myelodysplastic syndrome favors patients’ survival: a case control study and literature review. Autoimmunity reviews, 18(1):36-42.

Publisher | Google Scholor - Ogawa, S. (2019). Genetics of MDS. Blood, 133(10):1049-1059.

Publisher | Google Scholor - Al‐Shaikhly, T. and H.D. Ochs. (2019). Hyper IgE syndromes: clinical and molecular characteristics. Immunology and cell biology, 97(4):368-379.

Publisher | Google Scholor - Voso, M.T., et al. (2013). Revised International Prognostic Scoring System (IPSS) predicts survival and leukemic evolution of myelodysplastic syndromes significantly better than IPSS and WHO Prognostic Scoring System: validation by the Gruppo Romano Mielodisplasie Italian Regional Database. J Clin Oncol, 31(21):2671-2677.

Publisher | Google Scholor - Pellagatti, A. and J. Boultwood. (2015). The molecular pathogenesis of the myelodysplastic syndromes. European journal of haematology, 95(1):3-15.

Publisher | Google Scholor - Gu, S., et al. (2021). A novel scoring system integrating molecular abnormalities with IPSS-R can improve the risk stratification in patients with MDS. BMC cancer, 21(1):1-9.

Publisher | Google Scholor - Vedel-Krogh, S. (2020). The search for the “healthy” blood eosinophil count. Eur Respiratory Soc.

Publisher | Google Scholor - Heimall, J., A. Freeman, and S.M. Holland. (2010). Pathogenesis of hyper IgE syndrome. Clinical reviews in allergy & immunology, 38(1):32-38.

Publisher | Google Scholor - Chang, T.W., et al. (2007). Anti‐IgE antibodies for the treatment of IgE‐mediated allergic diseases. Advances in immunology, 93:63-119.

Publisher | Google Scholor - Montalban‐Bravo, G. and G. (2018). Garcia‐Manero, Myelodysplastic syndromes: 2018 update on diagnosis, risk‐stratification and management. American journal of hematology, 93(1):129-147.

Publisher | Google Scholor - Gernez, Y., et al. (2018). Autosomal dominant hyper-IgE syndrome in the USIDNET registry. The Journal of Allergy and Clinical Immunology: In Practice, 6(3):996-1001.

Publisher | Google Scholor - Farmand, S. and M. Sundin. (2015). Hyper-IgE syndromes: recent advances in pathogenesis, diagnostics and clinical care. Current opinion in hematology, 22(1):12-22.

Publisher | Google Scholor - Chularojanamontri, L., et al. (2009). Role of Omalizumab in a Patient with Hyper-IgE Syndrome and Review Der-matologic Manifestations. Asian Pacific Journal of Allergy and Immunology, 27(4):233.

Publisher | Google Scholor