Research Article

Impact Of Globalization on The Economic Growth in Nigeria (1987-2021)

- Adeoye Peter Ayodeji *

Department of Economics Kwara State University, Malate, Kwara State, Nigeria.

*Corresponding Author: Adeoye Peter Ayodeji, Department of Economics Kwara State University, Malate, Kwara State, Nigeria.

Citation: Adeoye Peter Ayodeji. (2024). Impact Of Globalization on The Economic Growth in Nigeria (1987-2021). Journal of BioMed Research and Reports, BioRes Scientia Publishers. 5(4):1-9. DOI: 10.59657/2837-4681.brs.24.105

Copyright: © 2024 Adeoye Peter Ayodeji, this is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Received: August 20, 2024 | Accepted: September 20, 2024 | Published: October 02, 2024

Abstract

This work examines the impact of globalization on the economic growth in Nigeria. Yearly data were used from 1987 to 2021. The Ordinary Least Squares technique of analysis (OLS) was used to analyze the data, and the yearly data were sourced from the World Development Indicator (WDI) and the Nigeria Bureau of Statistics. This research work considers the Gross Domestic Product of Nigeria as a measure of economic growth and other variables like Foreign Direct Investment, Import, Export, and Trade Liberalization which is also used to measure globalization. Based on the OLS approach, a test was carried out on each dependent variable and the independent variable to check the long and short-run regression findings for the coefficient of the lagged values of the dependent and independent variables. Some diagnostic tests like the serial correlation test, heteroscedasticity test, and stability test were also carried out on the variables. From the results obtained, the import of goods and trade liberalization were negatively and positively statistically significant respectively in explaining the economic growth rate. Also, FDI has a positive statistical relationship with economic growth. It is therefore recommended that special attention should be given to export activities and foreign investment in Nigeria, such as increased budgetary allocation to encourage export in Nigeria and to ensure proper implementation of programs. Also, there should be an effort of the government to reduce export duties to encourage citizens who are into exporting goods and services, to inject more money into the Nigerian economy.

Keywords: globalization; international trade; economic growth; balance of trade; foreign direct investment; trade liberalization

Introduction

Globalization is the increasing economic integration and interdependence of national, regional, and local economies across the world through an intensification of cross-border movement of goods, services, technologies, and capital. The concept of globalization is multi-dimensional that is it could be viewed from economic, social, and political dimensions. Globalization is a phenomenon that has been embraced by all nations and shaped the global world. Although not new, it has intensified in its ramifications in recent years and become a very important issue for discussion in various forums as it began to occur at an increased rate over the last 20-30 years under the framework of the General Agreement of Tariff and Trade (GATT) and World Trade Organization (WTO). Over the past decades, the economies of the world have become increasingly linked through international trade of goods and services and through foreign capital and investment which have removed all forms of trade barriers between countries of the world. The interdependence of the world economy brought about by globalization indicates that no economy is an island on its own because it has facilitated the exchange of ideas, production techniques, natural resources, skills, and even human resources. The 21st-century debate of nations is on how to reap the fall-scale benefits of the globalization of the world’s economy. Globalization leads to increased openness of economies to international trade, financial flows, and direct foreign investment (FDI). Today Globalization is similar to Foreign Direct Investment (FDI) or Foreign Private Investment (FPI), trade liberalization, that is, investment foreign investors have in developing countries where the resources are available, headquarters is located at the developed countries (Adesoye, Ajikw, & Maku, 2015). The impact of globalization on the development process of emerging economies has aroused a closer and more critical examination of the vestiges of globalization as a result of the persistent failures of such economies. The economic situation of most less developed economies has continued to desecrate and is often afflicted by poverty, squalor, deprivation, frustration, and insecurity among their citizenry, all of which culminate in political instability. Increases in the outputs of major sectors of an economy, such as manufacturing and natural resources either as a result of increases in the use of inputs or improvements in the technology will lead to economic growth. Economic growth is driven by a process that is generated and sustained by the effective utilization of a country's economic resources (Shuaib, 2015; Ogedengbe, 2015) Economic Growth means an increase in the real per capita income. This implies that on average, each person gets more goods and services and a higher standard of living than before. For more goods and services to be produced to achieve economic growth, more people have to save and invest. Economic Growth is a source of advanced living standards and can be seen as a rise in the gross domestic or national product of a country (GDP/GNP) over time which ultimately leads to high income per capita. Under the Keynesian approach to national income determination, Economic Growth or Gross Domestic Product is also referred to as Aggregate demand. Economic Growth represents the expansion of a country's potential GDP or output. GDP has remained the commonest measure of economic performance and market expansion. It is generally accepted that globalization plays an important role in the interdependence of economies. Over the years, the Nigerian government has globalized internationally with many countries around the world. Given the nature of Nigeria's state with its inherent weak domestic base, globalization has its adverse implication on the nation’s economy which will also have an almost negative effect or influence on the country’s Gross Domestic Product/ Gross National Product in terms of Economic Growth. Though globalization helped Western countries to get developed which in turn made the GDP of these countries grow immensely. Even though Nigeria has globalized politically, socially, and economically, there has not been a sign of growth in the economy at large. The problem of globalization in Nigeria can be said to be the overdependence on foreign countries. This can severely affect GDP if any economic crisis occurs in those foreign countries. Another problem could be due to negligence and errors on the part of our economic managers and the government especially, the oil boom era which made Nigeria, because of the high demand for crude oil to fuel rapidly growing globalization, shift attention from agricultural exploits to crude oil. Also, the Nigerian government lost control of the policy-making process and is under pressure to accept dictation from creditor nations and financial institutions. They tend to discuss development issues less with our nationals and more with donors and creditors about debt relief, debt repayment, and rescheduling. There is little to celebrate about globalization in Nigeria because Nigeria is still suffering from infrastructural decay, grinding conditions of poverty, and weak institutions that cannot actively and effectively participate in the global order. A country like Nigeria which is still battling with the forces of backwardness and economic stagnation cannot effectively harness the benefits of globalization. This study will further reveal the influence globalization tends to have on the economic growth of Nigeria.

Research Objectives

The main objective of the study is to access the impact of globalization in concern to the economic growth in Nigeria. The study will focus on working on the following objectives:

To examine the trend between globalization and economic growth in Nigeria.

To analyze the impact or contribution of globalization on Economic Growth in Nigeria.

Research Hypotheses

Ho1: There is no trend between globalization and economic growth in Nigeria.

Ho2: There is no relationship between globalization and economic growth in Nigeria.

Significance of Study

This study is important at this time because globalization can play an important role in increasing the economic growth in Nigeria. Adjustments to international trade and globalization can be made quickly, and the central authorities can devote considerable resources to monitoring and analyzing the growth of the economy. The world has simultaneously benefited from globalization and failed to manage the inherent complications resulting from the increased integration of our societies, our economies, and the infrastructure of modern life. Proponents of globalization believe that it allows developing countries to catch up to industrialized nations through increased manufacturing, diversification, economic expansions, and improvement in the standard of living. However, economic downturns in one country can affect the economies of other countries as a result of globalization which in turn also affects the economic growth of a country. This study, though principally to fulfill academic requirements, contributes to the knowledge and understanding of the workings of globalization as it relates to the growth of the economy in Nigeria. This study will also attempt to ascertain whether globalization generates a positive or negative impact on the Nigerian economy.

Literature Review

Globalization and Economic Growth in Nigeria

The integration of the world economy through the progressive globalization of trade and finance has reached unprecedented level most especially in the recent times, surpassing the pre-world war I peak (Lall, et al. 2007). The international competitiveness brought by new flow of globalization has brought huge progress and development to the world economy. The global economy has continued to observe active expansion of 2007 with growth running above 5% (IMF, 2007). In the face of the new wave of globalization, no country wishes to be left behind in the distribution of the benefits resulting from trade, foreign investment, and financial integration (international capital flows). Nigeria had accepted globalization since the 1980s with the assumption that enhanced free trade, competitiveness, financial integration, foreign investment, and technological development would ensure the attainment of rapid growth of the economy. Opposing expectation, the growth pattern of the economy since the 1980s has been very disappointing with poverty incidence increasing rapidly. According to the World Bank (2002), about 65% of the Nigerian population lives below the poverty line, with Nigeria being ranked among the poorest countries of the world, despite its vast economic potential as well as its attendant natural resources. There was a substantial increase in oil production accompanied by a sharp increase in the global market price of high-grade crude oil from the low price of $3.8 per barrel in October 1973 to a skyrocketing price of $14.7 per barrel in January 1974. This trend continued till 1981 when the price of crude oil attained a high of $38.77 per barrel. Within the same period, total revenue from oil rose correspondingly from N180 million to N3.7 billion in 1975 (Osaghe, 1998). The increase in national wealth resulted in the government of the day embarking on rapid expansion of the public sector squandering of the wealth on expanding distributive instead of productive capacity; and increased dependence on external goods and inputs. By 1978, oil composed a total of 89.1% of Nigeria’s exports as against agriculture, which had plummeted in its contribution to export to 6.8% in the same year. The fact is that Nigeria’s commodity pattern has, since the advent of oil, been a mono-cultural one with the product being the only one the country depends upon for its foreign exchange earnings- a situation that has constrained the pace of its developmental efforts. The country’s manufacturing sector has emerged as a formidable engine of development in the kingdom with traditional exports in the agricultural sector performing quite successfully. The crucial factor in globalization is therefore technological capabilities which make more proper utilization of resources feasible while some think Nigeria has no justification to uncritically join the bandwagon over the euphoria about globalization. Broader trends have been integrated through the successful penetration of the world economy and the development of advanced technology without hindrance. In Nigeria, despite the global trend resulting in technological and economic interaction between Nigerian and other nations, it has been bedeviled with a high rate of unemployment, monumental corruption, low income per capita, insecurity, and infrastructural decay hence, it has not been able to fully utilize the economic and socio-political benefits of globalization. This according to Rupali (2008) has been the bane of inadequate utilization of the impact of globalization to the Nigerian state.

The Theory of Liberation

Liberalists emphasize the necessity of constructing the institutional infrastructure to support globalization. Liberalism undergoes the process of globalization as an extension of modernization. At the primary level, it is the outcome of natural human passion or human passion for economic welfare and political liberty. In liberalism, some forces interlink humanity across the planet and such connectivity is derived from humans and helps to maximize material well-being and to exercise basic freedom. They are productive in aspects like technological advancement, especially in the areas of communication, information, and transportation. They also make legal and institutional arrangements to help markets and liberal democracy extend on a Trans World scale. Most of the clarifications come from economics, business studies, law and politics, and international political economy, and all these have led to technical standardization, and harmonization among the administrative and translation arrangements between language, laws contracts, and guarantees of property rights. However, some facts were neglected in this theory and this overlooks the phenomenon of power. The supporters paid less attention to the forces that lie behind the establishment of technological underpinning. The developments attributed to human’s natural desire for needs only tend to overlook the historically situated life-worlds and they are culture blind. Everyone can’t be assumed to have an equal desire to increase globalism in their lives; hence, this defined the structural power inequalities in promoting globalism and reconstruction.

The Theory of Marxism

This theory is primarily involved with the production and social exploitation through unjust distribution, and also social emancipation through capitalism. According to Marxist, globalization occurs when the connectivity between the Trans-world enhances opportunities for profit-making. Karl Marx even anticipated the growth of globalism that “‘capital by its nature drives beyond every spatial barrier to conquer the whole earth for its market’. Marxists reject both liberalist and political realist explanations of globalization; they believe that it is the outcome of historically specific impulses of capitalist development. The logic of surplus accumulation on a global scale is its legal and institutional infrastructure. While examining the capitalist accumulation, the neo-Marxists in dependency and world-system examined it on the global scale in peripheral countries. Also, Neo-Gramscians mentioned the significance of the underclass struggles against globalizing capitalism through traditional labor unions, peace activists, peasants, and women, and also by new social movements of consumer advocates.

However, Marxists have an overly restricted account of power. The presence of the US hegemony, cultural domination, and racism are not reducible to class dynamics in capitalism. As it is too simplistic to see globalization as the result of drives for several accumulations, class is the primary key to power but not the only one. Globalizations also seek to investigate meanings and explore identities. Global weapons are made and people pursue global military campaigns for capitalist ends and also to interstate militarist culture that predates the emergence of capitalism.

Empirical Review

A study by Shuaib et al. (2015) focused on the impact of globalization on economic growth in Nigeria. The study covered the period from 1960 to 2010. The ordinary least squares (OLS) were used. This study revealed that globalization had a significant impact on economic growth in Nigeria. Adesoye et al. (2015), investigated the impact of economic globalization on output growth of the Nigerian economy (1970 – 2013). This study used the Engle-Granger cointegration and error correction model and found that at a higher exchange rate, an increase in foreign direct investment enhances the growth rate of output in Nigeria. Utuk (2015), examined the impact of globalization on economic growth in Nigeria in terms of trade and capital flows from 1970 – 2011. Using descriptive analysis, the study revealed that increased trade and capital flows caused by globalization can enhance the country’s growth performance. Ebong et al. (2014), also examined ‘’Globalization and the industrial development of Nigeria’’. This study spanned the period between 1960 and 2010 while using the Johansen cointegration technique. The findings indicate that globalization had a significant impact on industrial development in Nigerian. Trade openness showed a direct effect on industrial development.

Adeleke et al. (2013), in their study, examined globalization and economic development in Nigeria. Using the cointegration technique and Granger causality tests, their findings revealed that FDI influences the level of economic growth in Nigeria. The findings equally revealed a one-directional causality from FDI to growth. Sede and Iz (2013), investigated the relationship between economic growth and globalization in Nigeria. This study used the Granger causality method of analysis. The findings indicated that globalization does not granger cause economic growth. Omolade et al. (2013), investigated the link between globalization and economic development in Nigeria. The study adopted Johansen cointegration and Granger causality tests and found that trade openness is inversely related to economic development in Nigeria. This study equally indicated a one-directional causality movement from economic development to globalization, but not vice-versa. This implied that Nigeria’s trade partners were gaining more than the country, especially the developed trade partners.

Methodology

The essence of economic modeling is to represent the phenomenon under consideration in such a way as to enable the researcher to attribute numerical values to the concept; The Impact of Globalization on Economic growth of Nigeria as adopted in Aderinto (2021).

RGDP= F (FDI, IMP, EXP, TL) ………………. 1

RGDP= ß0 + ß1FDI + ß2 IMP + ß3 EXP + ß4 TL ………….2

RGDPt= ß0 + ß1 FDIt+ ß2 IMPt + ß3EXPt +ß4 TLt + ut……….3

Where;

FDI = Foreign Direct Investment

IMP = Import

EXP= Export

TL= Trade Liberalization

= Error term

= Error term

ß1, ß2, ß3, and ß4 = the coefficient of the independent variables.

= Error term or stochastic term that is used to capture other variables that are not included in the model, the variance of the residual is not constant.

= Error term or stochastic term that is used to capture other variables that are not included in the model, the variance of the residual is not constant.

Estimation Techniques

This research work makes use of an econometric approach in estimating the effects of globalization on economic growth in Nigeria. The empirical analysis is being limited to the period between 1987 and 2021 due to the large number of years involved. Information and data needed for the study will be gathered from existing literature and from relevant government agencies such as the Central Bank of Nigeria (CBN). The study utilized the Unit Root Test to check the stationarity or non-stationarity of the individual variable; after which determined the estimation technique to use due to the nature of the variables, due to the result obtained from the unit root test, whereby all variables were stationary at levels I (0). OLS (Ordinary Least Squares) is a suitable estimation technique when variables are at order 0 and none is at order 1. It is important to know that OLS will not be suitable to use when variables are at order 1 and some are at order 0. OLS is good for estimating coefficients of linear regression equations which describe the relationship between one or more independent quantitative variables and a dependent variable.

Discussion of Findings

This section includes descriptive statistics on the value of Gross Domestic Product (GDP), Foreign Direct Investment (FDI), Trade Liberalization (TL), Import (IMP), and Export (EXP) of goods and services. It's a numerical description of the characteristics of the various variables that will be used and analyzed in the following sections. The data summary is shown below.

Table 1: Summary of the descriptive statistics of Gross Domestic Product (GDP), Foreign Direct Investment (FDI), Trade Liberalization (TL), Import (IMP) and Export (EXP).

| FDI | TRAL | IMP | EXP | RGDP | |

| Mean | 1.697938 | 35.23385 | 14.79683 | 21.17518 | 6.928924 |

| Median | 1.501216 | 35.25827 | 13.41463 | 21.13515 | 6.797213 |

| Maximum | 5.790847 | 53.27796 | 22.81126 | 36.02327 | 8.038830 |

| Minimum | 0.195183 | 9.135846 | 5.771463 | 9.218110 | 5.599251 |

| Std. Dev. | 1.249302 | 10.31464 | 4.487779 | 6.625195 | 0.773496 |

| Skewness | 1.672433 | -0.431293 | 0.109144 | 0.104016 | -0.004608 |

| Kurtosis | 5.697444 | 2.924827 | 2.288063 | 2.370755 | 1.417637 |

| Jarque-Bera | 26.15781 | 1.062081 | 0.785547 | 0.622237 | 3.547272 |

| Probability | 0.000002 | 0.587993 | 0.675182 | 0.732627 | 0.169715 |

| Sum | 57.72990 | 1197.951 | 503.0924 | 719.9561 | 235.5834 |

| Sum Sq. Dev. | 51.50491 | 3510.928 | 664.6253 | 1448.476 | 19.74377 |

| Observations | 34 | 34 | 34 | 34 | 34 |

Researcher’s Analysis using EViews 9

The mean, median, minimum and maximum values, kurtoisis, skewness, and Jacque-bera for both the explained and explanatory variables are shown in Table 1. The mean is a single value that reflects the centre of the series or the average value seen in the series. It is used to describe a sample. The value of foreign direct investment (FDI) has a mean value of 1.69, which is the lowest among the series, while trade liberalization (TRAL) has the highest mean value of 35.234. Like the mean, the median is a measure of central tendency that shows the value in the middle of the series that separates the higher and lower values. It's the number that splits a series in half.

The standard deviation of all the variables is large, which is very far to zero; this observation shows that the values of all the variables have a wider range around their mean value. Skewness informs the distribution features of the series; it measures the direction as well as the degree of asymmetry. A normal distribution is a symmetric distribution with a value of zero, a negative value of skewness indicates that the distribution is skewed to the left i.e. left-tailed in which case the mean is less than the median. The skewness values of trade liberalization and gross domestic product (GDP) is negative which means it is distribution have a left-tail, while FDI, EXP, and IMP is exhibiting the features of a right-tailed distribution as it is having positive values greater than zero.

The kurtosis values in the above table are all positive and far from zero, implying that their distributions are more peaked than a normal distribution. The Jacque-Bera test is a goodness-of-fit test that determines if the sample data series has kurtosis and skewness values consistent with a normal distribution. This test's results are always nonnegative, and the farther they are from zero, the less likely the sample data is to follow a normal distribution.

Unit Root Test

The preliminary step in this analysis is concerned with establishing the degree of integration of each variable since the study employed time series data. For this purpose, to get reliable results of the model, the implied assumption is that all the variables in the model are I (1) and co-integrated. On this note, the study applied the test for the existence of a unit root in the level and first difference of each of the variables in the data using the Augmented Dickey-Fuller (ADF) test. This is a well-accepted test statistic to check the stationarity of the series. The results presented in Table 2 reveal that only real GDP is stationary at level, it is I (0) while others are also stationary at levels. None of the variables are stationary at first difference I (1). Hence, Ordinary Least Square is a good instrument to use.

Table 2: The Result of the Unit Root Test

| Variable | Level (t-Stat) | Critical value | P-Value | Decision |

| RGDP | -3.495315 | -2.954021 | 0.0145 | I (0) |

| FDI | -3.800969 | -2.954021 | 0.0068 | I (0) |

| TRAL | -3.600098 | -2.954021 | 0.0112 | I (0) |

| IMP | -3.289605 | -2.954021 | 0.0263 | I (0) |

| EXP | -3.287250 | -2.954021 | 0.0189 | I (0) |

Researcher’s Analysis using E Views 9

Regression Test Results

Table 3: Ordinary Least Squares Model

| Dependent Variable: RGDP | ||||

| Method: Least Squares | ||||

| Date: 10/29/34 Time: 13:03 | ||||

| Sample (adjusted): 1987 2020 | ||||

| Included observations: 34 after adjustments | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| FDI | -0.811784 | 0.535828 | -1.515008 | 0.1406 |

| EXP01 | 0.157554 | 0.109755 | 1.435500 | 0.1618 |

| IMP | -0.336565 | 0.178307 | -1.887557 | 0.0511 |

| TRAL | 0.191619 | 0.078185 | 2.450842 | 0.0205 |

| C | 0.583987 | 2.788849 | 0.209401 | 0.8356 |

| R-squared | 0.284525 | Mean dependent var | 4.313235 | |

| Adjusted R-squared | 0.185839 | S.D. dependent var | 3.974503 | |

| S.E. of regression | 3.586228 | Akaike info criterion | 5.527132 | |

| Sum squared resid | 372.9699 | Schwarz criterion | 5.751597 | |

| Log likelihood | -88.96124 | Hannan-Quinn criter. | 5.603681 | |

| F-statistic | 2.883133 | Durbin-Watson stat | 1.231975 | |

| Prob(F-statistic) | 0.039936 | |||

Researcher’s Analysis using EViews 9

Table 3 presents the results of the OLS. The coefficient of determination (R2) of 0.284 shows that about 28.4% of the total systematic variations in the dependent variable (economic growth) is explained by the explanatory variables taken together. This doesn’t indicate a good fit of the regression line and also the model does not have a high forecasting power. The Durbin-Watson (DW) statistic value of 1.23 is a significant improvement on the preliminary OLS and hence indicates the presence of auto-correlation. Based on the overall statistical significance of the model, as indicated by the F-statistic, it is observed that the overall model is statistically significant with a calculated F-value of 2.88. This implies that there exists a significant linear relationship between economic growth and all the explanatory variables. From the estimate, trade liberalization is positive and significant, foreign direct investment and export of goods is also positive but not significant, while import of goods and services is negative and significant, hence, at a 5% level of significance.

The short-run simple linear regression impact of foreign direct investment and export of goods and services on economic growth at the current level whose p-value is given at 0.1436 and 0.16 respectively and positive relationship. This implies that in the short run, holding other variables constant, foreign direct investment and export do not significantly affect economic growth because the p-value (0.14 and 0.16) is greater than 0.05. this suggests that the rate of foreign investment and export rate is not enough to improve economic growth. This coefficient does not conform to apriori expectation (FDI and EXP will significantly affect economic growth positively). The result implies that the economic growth of Nigeria is not really affected by the foreign investment made into Nigeria and also the export of goods and services, this might be because there hasn’t been enough investment from other countries into Nigeria. However, results also show that Nigeria's rate of export has been low to the extent of not significantly affecting economic growth.

The coefficient of import rate appears with a negative sign but is significantly significant as its p-value is stated at 0.05. Also, the coefficient of trade liberalization appears with a positive sign and also significantly significant as its p-value of 0.0205 is lesser than 0.05 level of significant. This conforms to the apriori expectation (import will hurt GDP, while trade liberalization will have a positive effect on GDP). This means that a unit increase in import rate will reduce economic growth by 0.336unit, with other factors remaining constant, which means that a one-unit increase in the import of goods and services will reduce GDP by 33.6% Moreover, a unit increase in the level of trade liberalization will increase economic growth by 0.191-unit, other factors remaining constant, which means that one-unit increase in trade liberalization will increase GDP by 19.1%. Thus, the study rejects the null hypothesis which states that “globalization has no significant impact on economic growth in Nigeria”. This result implies that import and trade liberalization's impact on economic growth is a significant determinant in Nigeria. The resultant effect of this is that the growth process in the economy will fall if the level of imports continues to increase in Nigeria. Also, the growth process in the economy will continue to increase if the level of trade liberalization increases. This will ensure improved globalization of the Nigerian economy.

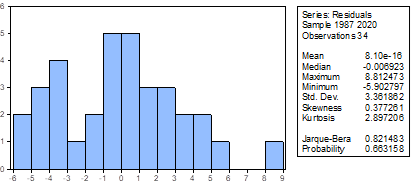

Normality Test

Figure

Researcher’s Analysis using EViews 9: The result shows that for the cost-of-living model, the residuals are not normally distributed. This is shown by the Jarque-Bera P-value which is significant at all levels.

References

- Adeleke, O., Akinola, M. and Chris, I. (2013). Globalization and economic development in Nigeria. Journal of Research in Humanities and Social Sciences, 1(4).

Publisher | Google Scholor - Adesoye, A. A., Ajike, E. O. and Maku, O. E. (2015). Economic globalization and economic growth in the developing economies: a case of Nigerian economy. International Journal of Economics, Commerce and Management, 3(7): 340-55.

Publisher | Google Scholor - Atobatele, E. (2016). Surmounting the challenges of globalization. Finance and Development, 39(1): 4-7.

Publisher | Google Scholor - Ebong, F., Udoh, E. and Obafemi, F. (2014). Globalization and the industrial development of Nigeria: Evidence from time series analysis. International Review of Social Sciences and Humanities, 6(2).

Publisher | Google Scholor - Omolade, A., Morakinyo, A. and Ifeacho, C. (2013). Globalization and economic development in Nigeria. Journal of Research in Humanities and Social Science, 1(4): 06-14.

Publisher | Google Scholor - Sede, I. P. and Iz, l., E. I. (2013). Economic growth and globalization in Nigeria: A causality analysis. Asian African Journal of Economic and Econometrics, 13(2).

Publisher | Google Scholor - Shuaib, I. M., Ekeria, O. A. and Ogedengbe, A. F. (2015). The impact of globalization on the growth of Nigerian economy from 1960–2010: Error correction model analysis. British Journal of Economics, Management and Trade, 7(1).

Publisher | Google Scholor - Utuk, I. O. (2015). Globalization and economic growth: The Nigerian experience. Journal of Law, Policy and Globalization, 36: 18-28.

Publisher | Google Scholor